Introduction:

In an era of digital transformation, economic uncertainty, and widespread adoption of decentralized technologies, understanding the evolving world of finance is no longer optional—it’s essential. That’s where Coyyn comes in.

As a modern financial empowerment platform, It merges education, insight, and applied strategy across domains like crypto, digital banking, the gig economy, private equity, innovation, and rare assets. For investors, professionals, and entrepreneurs in the USA, Coyyn provides a go-to resource for navigating the financial landscape with confidence.

In 2025, where AI-driven asset management, tokenized real estate, and peer-to-peer economies are maturing, Coyyn’s approach of simplifying complexity is more timely than ever. This article explores the key verticals Coyyn covers, how it empowers users, and why it stands out in a busy financial content ecosystem.

What is Coyyn? The Platform and Its Core Mission

At its core, Coyyn is a financial knowledge and strategy hub built to meet the needs of modern users—from first-time crypto traders to seasoned investors navigating shifting economic ground.

Coyyn’s Core Offerings:

- Curated articles across finance, crypto, and digital economics

- Tutorials on using wallet apps, trading platforms, and DeFi protocols

- Research-backed insights on rare assets, from coins to collectibles

- Business models decoded—ideal for solopreneurs and side hustlers

It doesn’t aim to hype trends. Rather, it explains, contextualizes, and helps users act wisely in today’s financial reality.

The Rise of Financial Literacy in 2025

Financial literacy isn’t just about balancing checkbooks—it’s about mastering digital tools, understanding cryptocurrencies, evaluating disruptive business models, and identifying compounding revenue streams.

Key Drivers of Financial Literacy:

- Decline of traditional banking models

- Rise of Web3 applications

- Unpredictability of global economies

- Growth in personal branding and monetization

Coyyn meets this shift head-on, offering content and strategy guidance geared toward modern financial independence. It’s a hub designed to grow your economic IQ—from crypto to collectibles.

Crypto Education: Navigating Bitcoin, Altcoins & Beyond

In 2025, cryptocurrencies have evolved from speculation to infrastructure. It helps users transition from wondering “Should I buy Bitcoin?” to asking “How can I use crypto to maximize freedom and security?”

Key Focus Areas:

- Bitcoin vs. Ethereum: What’s changed in 2025?

- Stablecoins, Layer 2s, and the widespread DeFi shift

- How to store crypto securely in today’s environment

- Regulatory updates: USA’s current crypto landscape (as of May 2025)

Chart: Popular Crypto Usage Cases in 2025

| Use Case | % of Crypto Users in USA |

| Payments (P2P or Business) | 48% |

| Long-Term Investment | 67% |

| DeFi Services | 33% |

| NFTs and Digital Ownership | 15% |

It goes further than headline cycles, focusing on risk management, security best practices, and multi-platform user guides tailored to informed action.

Coyyn & The Gig Economy: Tools for Freelancers & Creators

More Americans than ever are working contract jobs, building online brands, or freelancing on platforms like Upwork, Fiverr, and Substack. It equips this growing sector with:

- Budgeting tools tailored for periodic income

- Tax planning for 1099/K-Income

- Passive income strategies (DeFi staking, dividend coins)

- How to launch a crypto-friendly business in the gig economy

It turns gig workers into self-financed entrepreneurs, not just earners.

Embracing Digital Banking the Coyyn Way

Digital-first banks, neobanks, and DeFi wallets have replaced many traditional checking accounts. It helps users navigate this shift by offering:

Guides & Reviews On:

- Choosing between big fintech players (Ally vs. Revolut vs. Chime)

- Managing crypto alongside USD in hybrid banks

- Digital lending, peer-to-peer borrowing/lending, and yield accounts

- Security protocols in online banking as of 2025

Table: Coyyn’s Top-Rated Digital Banks

| Bank/Platform | Unique Feature | Coyyn Rating |

| Revolut | Multi-currency support | 9.2/10 |

| Chime | Early wage access | 8.9/10 |

| Juno | Crypto + cash balance | 9.4/10 |

It also teaches users how to vet financial apps, spot scams, and create redundancy systems for digital wealth.

Investing in Innovation & Private Equity Starts Here

It doesn’t just cover crypto—it brings deep dives into emerging tech, especially where private capital is flowing.

Topics include:

- Investing in AI startups before Series A via tokenized equity

- Assessing climate-tech incubators with real ROI metrics

- Participating in security token offerings (STOs) in the USA

- Exploring chunks of venture funds via fractionalized tokens

Coyyn educates on how to invest early, wisely, and without the risks of FOMO-led decisions.

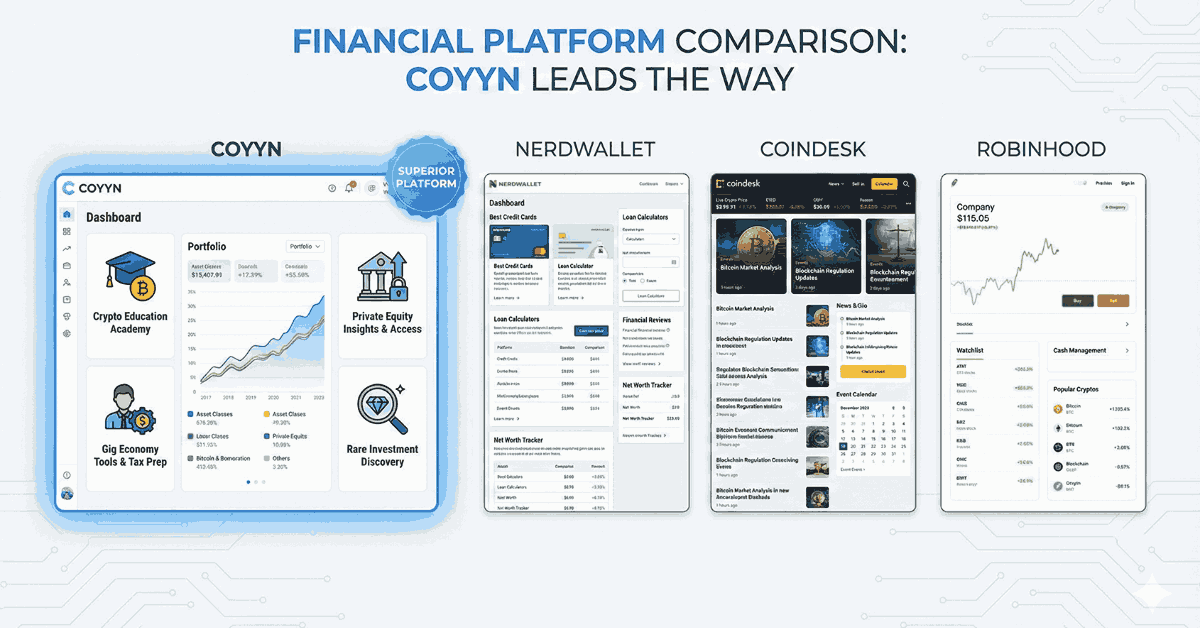

Coyyn vs. Other Financial Platforms:

There’s no shortage of platforms covering finance—from NerdWallet to CoinDesk to Robinhood Learn. So, how does it go beyond?

Table: Educational Finance Platform Comparison

| Platform | Crypto | Digital Banking | Gig Economy | Rare Coins | Private Equity |

| Coyyn | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

| NerdWallet | ✅ Yes | ✅ Yes | ❌ Limited | ❌ No | ❌ No |

| CoinDesk | ✅ Yes | ❌ No | ❌ No | ❌ No | ❌ No |

Unlike others that narrowly niche into tech or finance, Crypto blends functionality with accessibility, offering both cutting-edge coverage and foundational understanding.

How Coyyn Breaks Down Complex Financial Concepts

Whether you’re a curious college student or a corporate CFO, Crypto makes financial topics readable, relatable, and relevant:

What Makes Coyyn’s Content Stand Out?

- Uses plain language analogies to explain tokens, stocks, APYs, NFTs, and regulation

- Embeds interactive visuals, including timelines and tracked portfolios

- Highlights actionable steps, not just theory—every article ends in “How to Get Started.”

For example, instead of saying “invest in DeFi,” Coyyn would explain:

Rare Coins, Tokenized Assets & Alternative Investments

It also dives into tangible, alternative, and collectable asset classes—a rare niche in combined platforms.

Topics Explored:

- Grading and valuing historical coins like Morgan dollars or Liberty Heads

- Tokenized access to fine jewelry, whiskey barrels, vintage cars, or gold bars

- How to verify legality and clean provenance of asset-linked tokens

With digital railroads like Ethereum or Polymesh powering authenticity, Coyyn provides a bridge between physical collectibles and modern tech.

How to Start Using Coyyn (and Maximize Its Value)

Ready to grow your financial intelligence and explore investments beyond basic budgeting apps?

Use Coyyn By:

- Visiting coyyn

- Creating a free user profile to curate topics

- Subscribing to personalized content segments (crypto, rare coin investing, digital banking)

- Access exclusive tutorials, launchpads, and newsletters

Data & Visuals

Chart: Coyyn User Demographics

| Category | Percentage (%) |

| Crypto Beginners | 34% |

| Digital Entrepreneurs | 28% |

| Gig Workers | 19% |

| Collectors/Investors | 12% |

| Financial Educators | 7% |

FAQs

Is Coyyn free to use?

Yes. Most of the content and tools are free, with premium insights also available.

Does itprovide investment advice?

No, it’s educational—not a financial advisory platform.

Can I learn crypto basics on Coyyn?

Absolutely. It has curated beginner guides for BTC, ETH, wallets, and trading.

Is Coyyn legit or a financial scam?

Itis a registered educational content platform with transparency and no pushy upsells.

Does Coyyn support mobile access?

Yes—the platform is fully mobile-optimized.

Conclusion:

In 2025, true financial freedom begins with knowledge—about where money is moving, how assets are evolving, and how to adapt responsibly. It delivers a unique, trustworthy space for everyday people and investors alike to explore the full spectrum of modern finance—from tokens to tangible coins, from crypto wallets to crowdfunding.

Whether you’re investing in your first crypto, exploring private equity, or learning how to bank without a bank—It is the financial roadmap for the next generation of American investors.